House Republicans Push Plan Forcing States To Cut Food Benefits For 42 Million Americans

A major federal program supporting tens of millions could see its funding structure drastically altered.

It’s a move lawmakers say is about responsibility, but others warn could reshape how vulnerable families access food.

Examining Proposed Changes to SNAP

House Republicans are advancing proposals that aim to significantly change the financial structure of the Supplemental Nutrition Assistance Program, known as SNAP.

Historically, SNAP benefits have been fully funded by the federal government, with states handling the administration of the program.

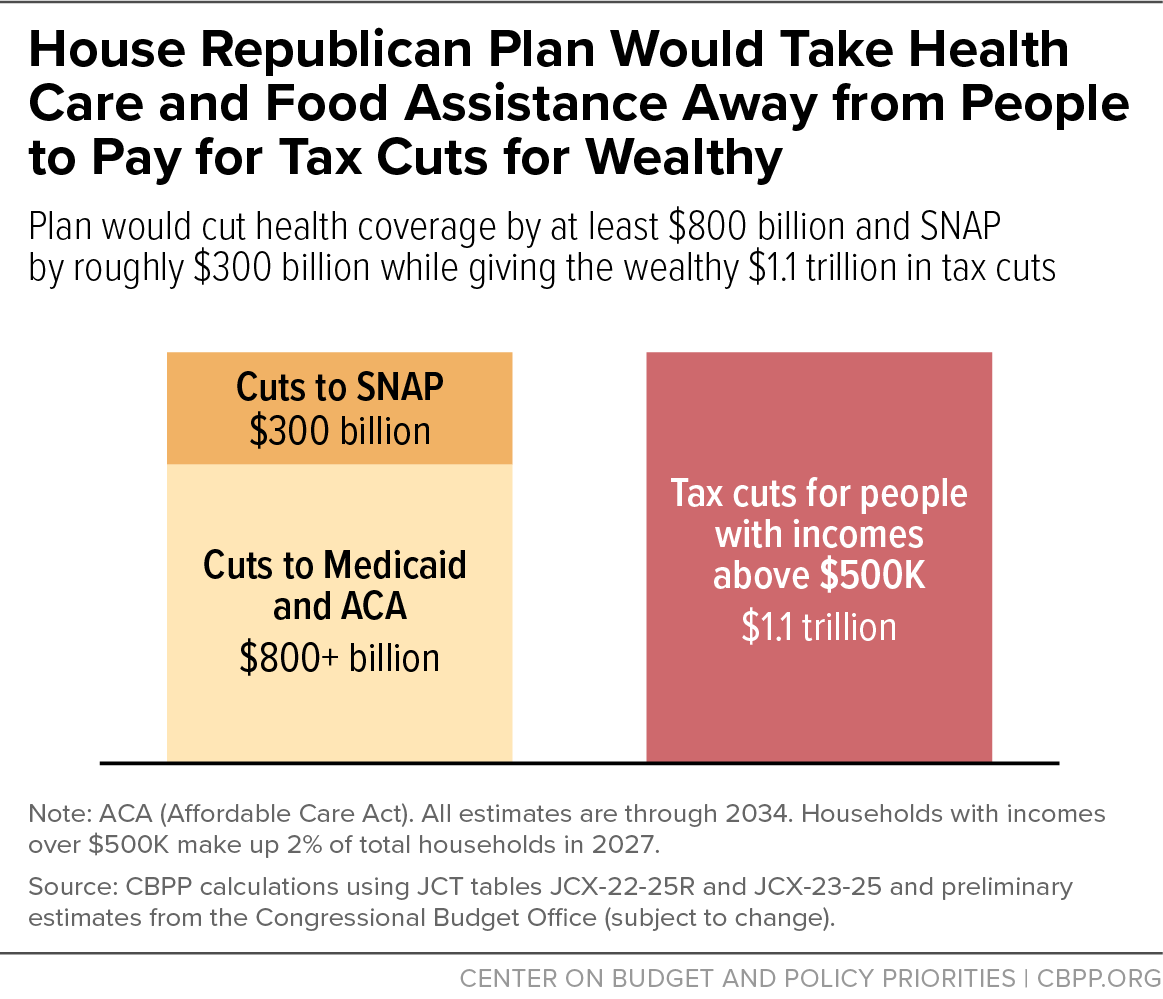

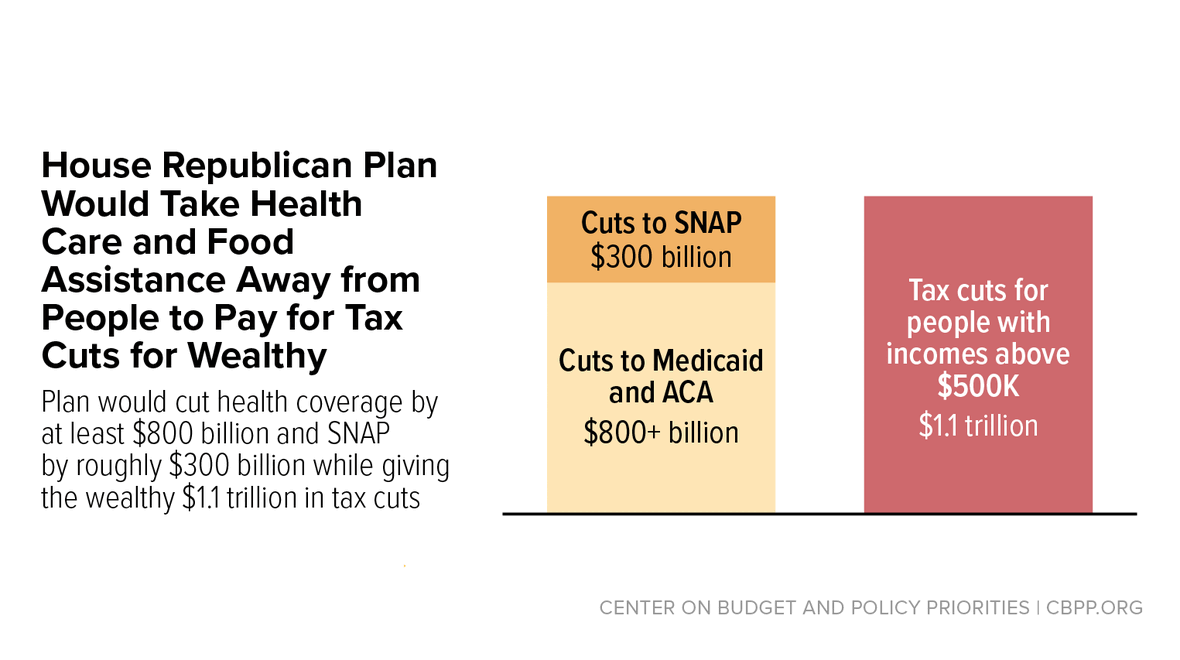

A recent measure approved by the House Agriculture Committee along party lines targets substantial savings from SNAP, potentially exceeding $290 billion.

A key component of achieving these savings involves shifting a portion of the program's costs, including benefit payouts and administrative expenses, onto individual states.

Differing Perspectives on the Impact

Advocacy groups have voiced strong concerns regarding these potential changes.

Haley Kottler from Kansas Appleseed, an anti-hunger organization, described the proposed shift in costs as unprecedented for SNAP.

“If these go through, it absolutely will wreak havoc on the program overall,” said Kottler. “For one, we don’t have that in our state budget right now, and two, lawmakers in Kansas do not have the political will to put any more money forth for SNAP.”

Concerns center on whether states have the financial capacity or political will to absorb these new costs, especially given balanced budget requirements in nearly every state.

Elaine Waxman, a senior fellow at the Urban Institute, highlighted that state offices administering SNAP have faced challenges, including increased error rates and staffing shortages, particularly following the coronavirus pandemic.

Critics argue that increasing the state's financial burden on administration from 50% to 75% could further strain these resources.

The Rationale Behind the Proposal

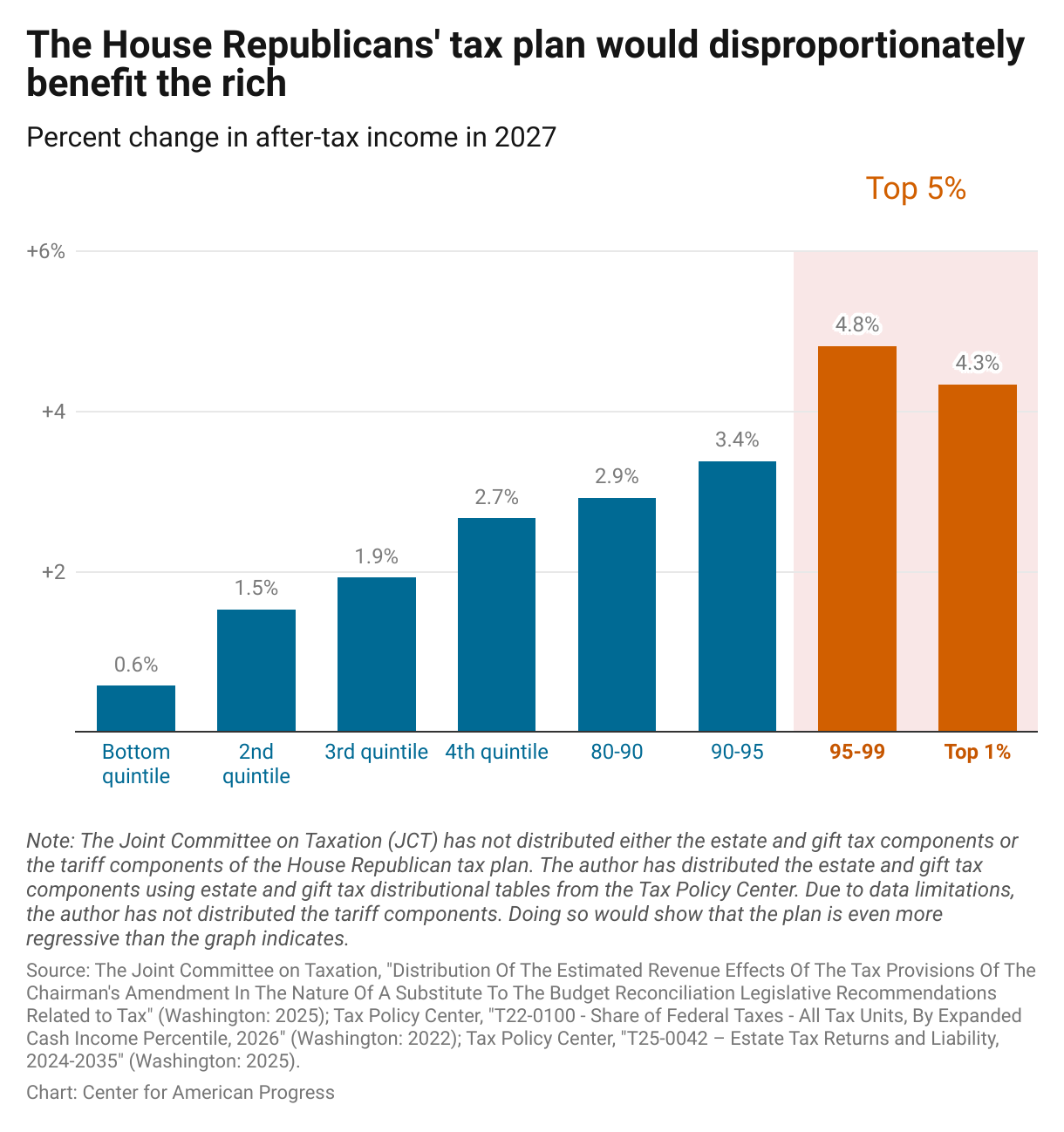

Supporters of the Republican plan argue that these changes are necessary for fiscal responsibility and reducing the national deficit.

They contend that giving states more financial stake in the program can incentivize greater efficiency and accuracy in administration.

The proposal links state cost-sharing directly to payment error rates, aiming to encourage states to reduce mistakes in benefit distribution.

Additionally, proposed changes to work requirements are framed by proponents as encouraging self-sufficiency and workforce participation among recipients.

Detailed Look at the Proposed Structure

Under the proposed legislation, which could take effect starting in 2028 if enacted, states would be required to cover between 5 percent and 25 percent of SNAP benefit costs.

This percentage would be determined by a state's payment error rate; states with higher error rates could face a larger cost share.

Data from 2023 indicates that many states had error rates that would place them in a category requiring them to pay a significant portion, potentially up to a quarter, of benefit costs.

Furthermore, states would see their share of administrative costs jump from the current 50 percent to 75 percent.

The bill also proposes lowering the tolerance level for errors from $37 to $0, a change that could potentially impact error rate calculations across the board.

Potential State Responses and Program Impacts

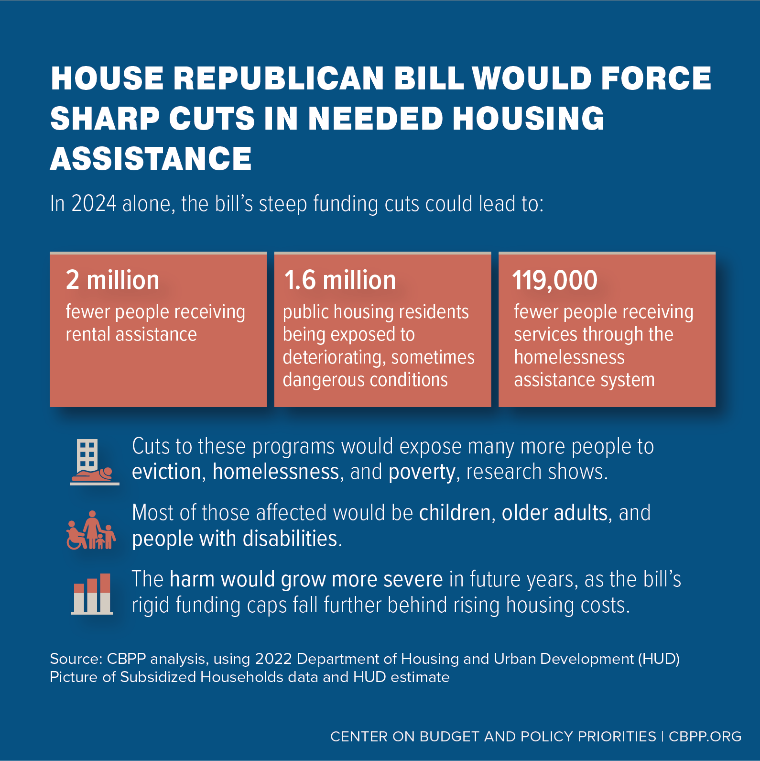

Facing increased costs, states might explore various options to manage their budgets.

One potential avenue discussed by analysts is the possibility of states reconsidering policies like "broad-based categorical eligibility," which streamlines access for families receiving other benefits.

Changes to this policy could increase the complexity of the application process for families.

The proposal also includes changes to SNAP work requirements, including extending the age limit for able-bodied adults without dependents from 54 to 64 and tightening exemptions for parents.

SNAP is often viewed as an "automatic stabilizer" during economic downturns, allowing rapid support for those experiencing job loss.

Economists highlight its role in providing an economic multiplier effect as recipients spend benefits locally.

Concerns have been raised about how transferring costs to states could affect this stabilizing function, especially given state budget limitations compared to the federal government.

While the proposals face an uncertain path forward, including potential challenges in the Senate, they highlight ongoing discussions about the future structure and funding of federal nutrition assistance programs.

The debate involves balancing goals of fiscal discipline and program efficiency with the objectives of providing food security and support to low-income Americans.