SHOCKING DRAMA: Republican lawmaker RIPPED from meeting over Trump tax fight

Tensions just boiled over in a major clash rocking the heart of Washington D.C.

A high-stakes negotiation hit a wall, leading to an absolutely wild scene behind closed doors.

Deep Divisions Emerge Over Key Tax Relief

Republicans are locked in a fierce internal battle right now over a critical part of the upcoming tax bill linked to President Donald Trump's agenda.

The issue is the federal deduction for state and local taxes, known as SALT.

Back in 2017, the Tax Cuts and Jobs Act capped this deduction at $10,000. Now, as Republicans look to extend those tax cuts, lawmakers from high-tax states are pushing hard to raise or eliminate that cap.

It's a complicated fight that pits key leaders against members determined to deliver relief for their constituents.

The Fight Hits the Tax Committee

At the center of the storm is Representative Jason Smith, the Chairman of the powerful House Ways and Means Committee, the main tax-writing panel.

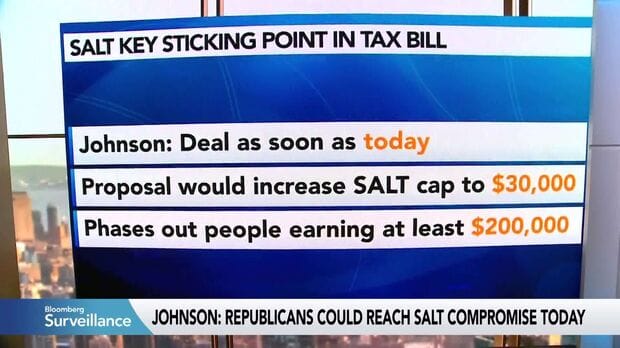

He's been working to move forward with legislation, including a proposal to raise the SALT cap to $30,000.

But a determined group of Republicans, particularly from states like New York, California, and New Jersey, argue this doesn't go far enough.

They represent districts where state and local taxes are significantly higher, making the current $10,000 cap a major pain point for many families.

Negotiations Get Intense

This intense debate involves heavy hitters like Representative Elise Stefanik of New York, a member of House leadership, who is deeply involved in trying to find a solution.

Other key New York Republicans, including Reps. Mike Lawler, Nick LaLota, and Andrew Garbarino, have also been vocal in demanding a higher cap.

These members are fighting tooth and nail for their districts, arguing that delivering meaningful SALT relief is crucial for their constituents and their political future.

With a narrow Republican majority in the House, this relatively small group holds significant leverage.

Finding a Path Forward Proves Tricky

Speaker Mike Johnson has been actively working to mediate and find common ground.

Reaching a consensus is vital to passing the broader tax package, which is a key legislative priority.

However, the pro-SALT group itself hasn't been totally unified, with different members willing to accept different compromise numbers.

Some have expressed frustration with colleagues they feel are settling for less than they should.

Chairman Smith has reportedly stated that his role is to negotiate within his committee, not necessarily directly with specific caucuses, adding another layer of complexity to the talks.

Meanwhile, some more conservative members of the conference are hesitant to raise the SALT cap significantly without corresponding spending cuts elsewhere.

The Dramatic Meeting Revealed

This is where the shocking drama unfolded.

During a strategy meeting for pro-SALT Republicans in Speaker Johnson's office this week, things got incredibly tense.

According to sources present, Representative Nicole Malliotakis of New York, who also serves on the Ways and Means Committee and supported the $30,000 cap proposal in committee, was asked to leave the room.

The stunning moment highlighted the deep distrust and frustration within the pro-SALT ranks as they struggled to unify their demands and strategy against the committee's proposal.

One source reportedly said she "wasn’t invited and is not part of our negotiation."

Malliotakis later told NBC News that as the only member of the SALT Caucus on Ways and Means, she believes changes ultimately require committee agreement.

She emphasized her goal is to reach a resolution to deliver "the one, big, beautiful bill for America" and confirmed huddling with leadership to find a path forward, noting the window for a deal was closing.

This intense episode underscores the passions involved as lawmakers work to find common ground on complex tax policy while representing their constituents' unique needs under the pressure of advancing major legislation.

The fight continues, with leadership pushing hard to bridge the divide and deliver a win on the tax front.